Thorough Financial Planning: the Pinnacle of Wealth Management

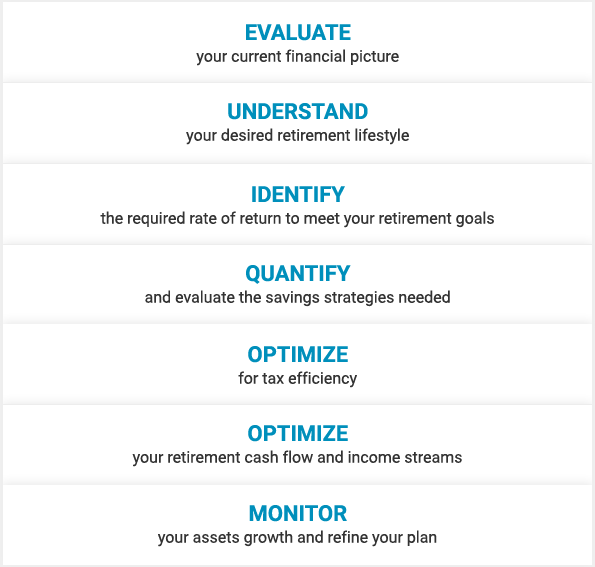

Personal financial planning is a process for optimizing your financial situation and your assets. Financial planning integrates knowledge from the areas of estates, finance, insurance and risk management, investment, legal aspects, retirement, taxation and more. (IQPF, 2019)

Oftentimes, advice is only obtained on one or two components of a person’s finances at a time, with little consideration for other variables. For example, we often meet individuals who have been obtaining stand-alone investment advice, disregarding the consequences of such advice on retirement and tax planning…